Two reasons why this won't work (unless you have a solution for both) -

1. Your invoice address needs to match your credit card address

2. The downloader will only let you download in the country that you specify

Ben

I see, well that sucks for a few us, and I

guess there’s nothing you can do about it.

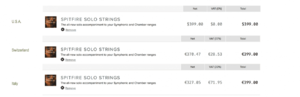

Just a few days ago I could have got BDT for $149.00, but yesterday it was $190. 20% more expensive Symphonic Strings is quite a lot when I’ve been waiting for a sale for a long time.

Last edited: